June 5, 2007

NORTH ANDOVER – While property taxes in North Andover continue to rise each year, and with an override on the horizon, and the average taxpayer in the Commonwealth of Massachusetts experiencing a property tax bill increase of 4.7% from fiscal year 2006 to 2007, some elected officials in North Andover actually saw their tax bills decline even though their assessed property values went up.

According to town records in North Andover, the average taxpayer saw his bill increase by 2% from the fiscal year 2006 to 2007, with the average singe-family tax bill going from $5,500 to $5,610.

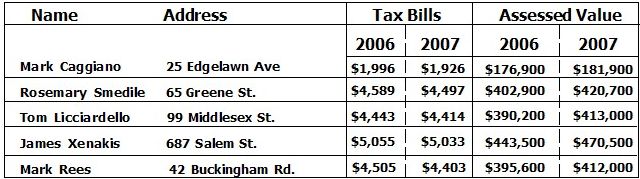

But, while tax bills continue to rise for most North Andover residents, four of the five selectmen as well as the town manager, saw their property tax bills go down. Selectmen Mark Caggiano, Rosemary Smedile, Tom Licciardello and Jim Xenakis all saw their tax bills decrease from 2006 to 2007.

Only Selectman Dan Lanen’s property tax bill went up. Lanen’s bill went from $4,611.27 to $4,668.16.

On the other hand, Selectman Caggiano’s property tax bill went down by $69.77 (from $1,996.35 in 2006 to $1,926.58 in 2007), even though the assessed value of his home rose by $5,000 (from $176,900 in 2006 to $181,900 in 2007).

Selectman Rosemary Smedile’s property taxes went down, too (from $4,589.48 to $4,497.02), while the assessed value on her home rose by $17,800 (see chart to the right).

Chairman of the Board of Selectmen Tom Licciardello’s property tax bill went from $4,443.76 to $4,414.13, while his property values rose by $22,800.

Jim Xenakis’ tax bill went down by $22 (from $5,055.32 to $5,033.07), but his property values rose by $27,000.

Town Manager Mark Rees’ tax bill went down. His tax bill dipped by $102 (from $4,505.71 in 2006 to $4,403.37 in 2007), but his assessed values rose by $16,400.

Last March The Valley Patriot published a column by Georgetown Selectman Lonnie Brennan, who reported that some officials in Georgetown were apparently receiving tax breaks. Coincidentally, the majority of the Board of Assessors in Georgetown had their tax bills decrease while the rest of the town’s taxes went up.

“The contrast is striking and the coincidence is amazing,” says Brennan of the tax bills of certain officials in Georgetown. “While a large number of town officials got hit with increases, one member of the Board of Assessors saw a 4.85% decrease… ,” he added.

When shown the information of the North Andover selectman’s tax bills, Brennan says that he was not surprised. “Am I the only selectman whose bills keep going up?” he asked. “I wonder how coincidental all of this is?” continued Brennan, comparing North Andover’s tax bills and Georgetown’s.

“I try not to get cynical when I hear of these things, but it sure doesn’t pass the sniff test,” Selectman Brennan said of neighboring Georgetown. “In Georgetown, we had a similar occurrence this past year: our chairman of the Board of Assessors, as well as his daughter, our town moderator, did quite well with the assessments on their properties. Meanwhile, others got hammered. It makes one wonder if dissenters such as Dan Lanen in North Andover and I might be targets because we oppose property tax overrides. Is there a not-so-subtle message being sent to us? Play along, get your back scratched, get your property taxes reduced?”

When Selectman Lanen learned that he was the only board member to pay more in taxes from fiscal year 2006 to 2007, he said was quite surprised but not shocked.

“Well, I can see why the other members continue to support overrides, that’s for sure. Their bills keep going down,” Lanen quipped. “All I hear about is how residents’ bills keep going up with seniors having trouble paying their bills. I will need to look into this further,” Lanen continued.

Lanen, one of the two selectmen who regularly opposes Proposition 2 1/2 overrides, said, “Maybe I would be supporting an override every year, too, if my tax bills weren’t always going up.”

To date, the ongoing investigation by The Valley Patriot into the tax assessment and property tax bills of Georgetown and North Andover have found no evidence of wrongdoing or illegality. The investigation is ongoing.